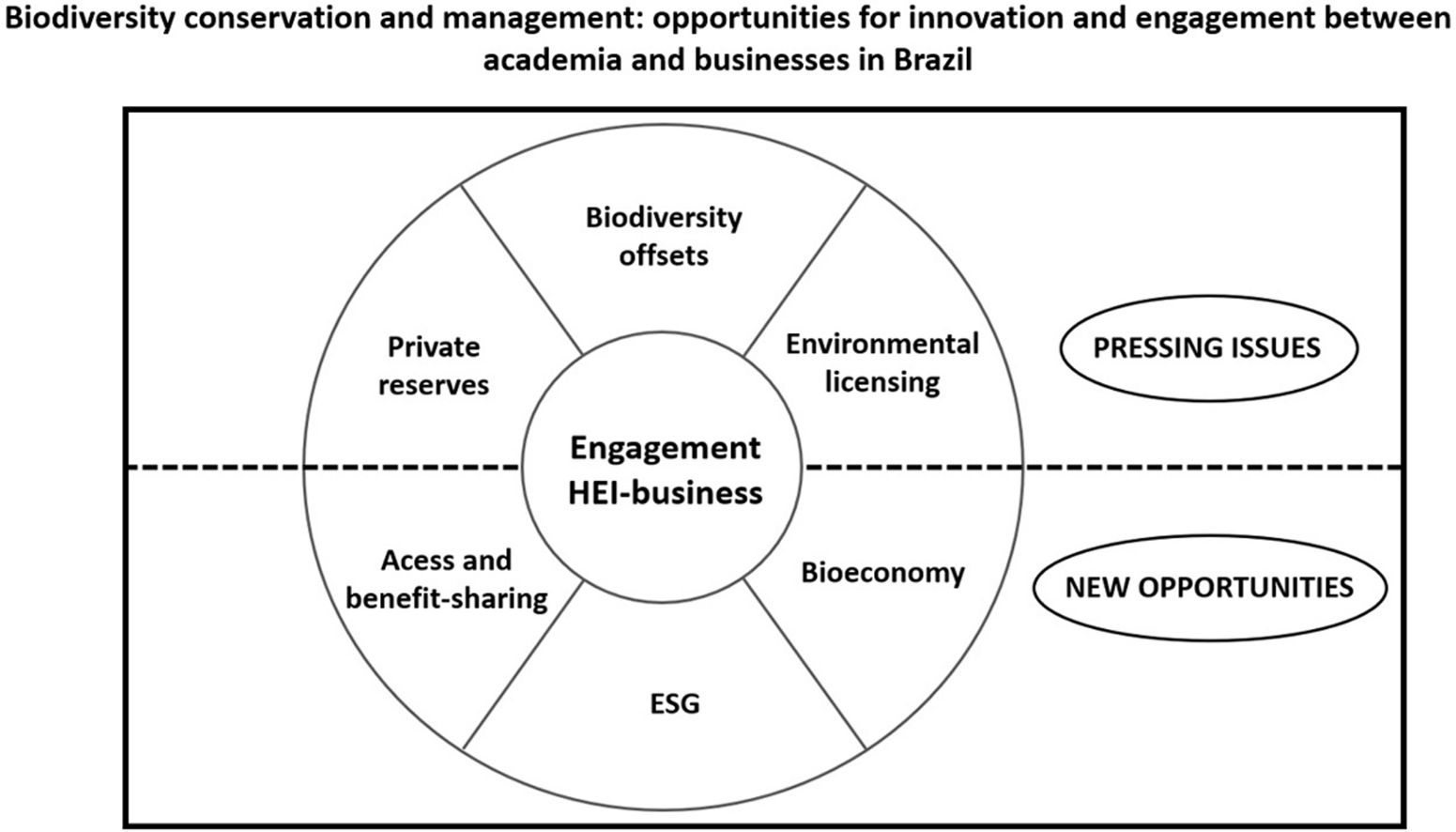

Official reports and academic studies call for profound and immediate transformations in how businesses relate to biodiversity. The urgency is such that the first draft of the Post-2020 Global Biodiversity Framework (GBF) of the Convention of Biological Diversity has a specific target aimed at full sustainability in biodiversity practices in businesses by 2030. Brazil—a country with the greatest reservoir of biodiversity and the 12th largest economy on the planet —should be fertile ground for new developments and innovations on this front. However, the shortage of academic engagement with businesses in the country may impede this path. We propose six biodiversity-related innovation fronts and opportunities for engagement between high education institutions and companies in Brazil. We reviewed the literature regarding two sets of practices: pressing issues (including environmental licensing, biodiversity offsets, and conservation in private reserves), and new business opportunities (sustainable bioeconomy, access and benefit sharing – ABS, and environmental and social governance – ESG). Such themes have direct relevance to the Post-2020 GBF business sustainability target and potential national impact. There is plenty of room for academic engagement with businesses in all cases. Examples include supporting definition of metrics and standards, providing information systems to increase transparency, among others. In conclusion, we argue that an innovative mindset from corporations and academics will be necessary before Brazilian businesses can move on to develop innovative and sustainable processes and products related to biodiversity.

Since shortly before the outbreak of the Covid-19 pandemic, many official reports and academic studies have called for profound transformations in how businesses relate to biodiversity (WEF, 2020; Dasgupta, 2021; IRP, 2021; UNEP, 2021). The European Union agreed upon and launched a Green New Deal (European Commission, 2019), and similar efforts have been proposed in the United States and China (Tagliapietra and Wolff, 2021). The rising awareness about climate change (IPCC, 2021) and the accelerating rates of species extinctions (IPBES, 2019) further increase the pressure for an effective business contribution to solving sustainability challenges. The current economic paradigm, which often considers biodiversity an externality, is no longer an option. Thus, the United Nations Convention on Biological Diversity proposed a business target (#15) in the official “first draft” of the new Global Biodiversity Framework: “all businesses (public and private, large, medium, and small) assess and report on their dependencies and impacts on biodiversity, from local to global, and progressively reduce negative impacts, by at least half, and increase positive impacts, reducing biodiversity-related risks to businesses and moving towards the full sustainability of extraction and production practices, sourcing and supply chains, and use and disposal” (CBD, 2021, p. 106). The draft also notes that “urgent policy action globally, regionally, and nationally is required to transform economic, social and financial models so that the trends that have exacerbated biodiversity loss will stabilize in the next ten years (by 2030).” (CBD, 2021, p. 40).

The need for direct business involvement in resolving the biodiversity crisis (Mace et al., 2018; Smith et al., 2020) is no surprise since the private sector is responsible for 60% of the gross domestic product (GDP) worldwide (Sukhdev, 2012), and 72% of the GDP of countries of the Organization for Economic Co-Operation and Development (OECD; Manyika et al., 2021). Although the private sector strongly depends on biodiversity and ecosystem services (Bishop, 2012; Dasgupta, 2021; UNEP, 2021), it has a significant environmental footprint (Moran and Kanemoto, 2017; Addison et al., 2018).

Locally, government initiatives are pivotal to balancing such forces and promoting pro-biodiversity actions and some countries have designed and implemented policies that seek to regulate the environmental performance of the private sector. However, complying with the national environmental legislation is no longer enough for the private sector. Nowadays, businesses must also build image and brand and respond to ever-increasing local or international demands for sustainable products since all these fronts impact mid- to long-term financial gains (Gradinaru, 2014; Dragomir, 2018). In the international arena, urgent reforms in trade investments and green procurement policies have been promoting fertile ground for sustainable businesses to flourish (Turnhout et al., 2020).

However, transformation requires more than changes in public and private policies. Corporations must be “ethical stewards of shared planetary resources” rather than “as they have been so far, self-interested exploiters of the commonwealth” (Sukhdev, 2012). The gradient between “stewards” and “exploiters” can be defined by the balance between environmental cost/gain for businesses vs. societal impacts that results from a given business action (Bhattacharya and Managi, 2013; Barkemeyer et al., 2015; Boiral and Heras-Saizarbitoria, 2015, 2017), which depends on business size, sector, history, and values. Much innovation is required to move from “exploiters” to “stewards,” beginning with a new business mindset.

Transformative change in the private sector requires solid policy measures combined with structural shifts in values and institutions (Turnhout et al., 2020). This transition in the business-biodiversity relationship requires innovation in mindset but also in process, and outcome (Kahn, 2018), related, for instance, to the development of socially inclusive technology (Siddiqi and Collins, 2017) and a new stand on human-nature relationships (Andrade et al., 2020). Academic engagement is central to this process because it has 1) the interdisciplinary knowledge and scientific rigor for the innovative process and 2) the freedom to test new processes, techniques, and products without the economic restrictions imposed on companies by the market. Therefore, higher education institutions (HEI) – such as Universities and Research Centers – can be seen as crucial innovation agents (Perkmann et al., 2021). This is particularly true in emerging economies (Kruss et al., 2015), where HEI can influence the rates of catch-up (for this and other terms, see Glossary in Table 1) in businesses (Lee and Malerba, 2017) and provide technological opportunities for the private sector (Puffal et al., 2021).

Glossary of terms used in this paper in the sequence they appear.

| Term | Meaning | Reference |

|---|---|---|

| Academic engagement | Knowledge-related collaboration by scientists with non-scientific organizations. | Perkmann et al. (2021) |

| High Education Institutes (HEIs) | Institutions that produce knowledge while providing education to students, such as universities and many research centers, public or private, for-profit or non-profit. | Perkmann et al. (2021) |

| Catch-up cycles | Phenomena of successive changes in industrial leadership. They occur when a given industry fails to maintain its superiority in technology, production, and marketing, providing room for a latecomer to catch up and gain leadership. | Lee and Malerba (2017) |

| Formats of engagement between HEIs and businesses | Engagement can be generic or relational. Generic links: transfer of knowledge or technology via human resource absorption (e.g., recruitment of personnel with graduate training), capacity building (high-level education and training offered to employees), scientific publications, or university-generated intellectual property (e.g., patents and licenses). Relational links: stronger partnerships that emerge from working on specific projects in collaboration or consulting. | Jones and Zubielqui (2017) |

| Corporate sustainability | We use this term in its broader sense, i.e., the fusion between corporate responsibility (that emerged from ethical concerns with the human component) and business sustainability (that emerged from environmental impact concerns). It also comprises Corporate Social Responsibility (CSR) and Environmental and Social Governance (ESG). | Bansal and Song (2017); Barbosa et al. (2019) |

| Biodiversity offsetting | Actions that ensure a positive balance for biodiversity, when comparing states before and after a corporate intervention in a natural area. However, some authors refer to it as simply neutralization or compensation of the impact on biodiversity. | Gonçalves et al. (2015) |

| Conservation incentives | Conservation incentives enable mechanisms whereby beneficiaries compensate providers for the additional provision or maintenance of desired ecosystem services. They can be financial or non-financial. Examples include Payments for Ecosystem Services, REDD+, environmental certification, conservation easements, and sustainable finance instruments. | Scarano et al. (2018b) |

| Transdisciplinary | A method driven scientific principle focused in societally relevant problems that enables mutual learning processes among actors from and outside academia. It aims to create solution-oriented knowledge, socially robust and transferable to both the scientific and societal practice | Lang et al. (2012) |

| Payments for Ecosystem Services | Voluntary transactions whereby a provider ensures a specific ecosystem service through a negotiation involving a buyer of this service. They existed in a rudimentary form for decades, but during the 1990s, they expanded as an integrative conservation mechanism. | Wunder et al. (2008) |

Moreover, HEI can often link areas and expertise across society and promote transdisciplinarity (Table 1), making them an expression of social stability, generally with a non-profit orientation that fosters long-term free-thinking, which is crucial to innovation and sustainability (Stephens et al., 2008). Of course, engagement also presents risks to both parties (Durst and Zieba, 2020), such as relational risks for companies (carefully choosing partners and defining protective legal agreements) and academic reputational risks. Non-engagement is also risky for companies (e.g., lack of internal competencies to address specific issues) and HEIs (e.g., distancing from practical matters). Durst and Zieba (2020) suggest that creating a culture of trust and data sharing between partners is one key strategy to make engagements work.

Business innovation that addresses sustainability concerns from a biodiversity perspective demands academic engagement that fosters transdisciplinary approaches (Compagnucci et al., 2021). Public HEI are major innovation centers in Brazil, especially in highly industrialized areas (Póvoa, 2008). Nonetheless, despite some successful cases of HEI-business partnerships in Brazilian technological history (Dutrénit and Arza, 2015; Puffal et al., 2021), such engagement is still incipient compared to other developing economies, such as in Asia (Lee, 2013; Fischer et al., 2019). This is at least partly attributed to the low absorption capacity of technology at the country level, as well as to flawed research and development projects in which HEI acts as a complement to or substitute for businesses in technology development (Póvoa, 2008; Botelho and Almeida, 2011), and to bureaucratic hurdles involved in mutual agreements on research, disclosure, confidentiality, licensing, and eventually even patenting and commercial use (Viana et al., 2018).

Brazil is a large economy where corporations of all sizes operate (Oliva et al., 2019). Since the country is the largest reservoir of biodiversity on the planet (Scarano et al., 2021), businesses are challenged to sustainably manage biodiversity and ecosystem services. At the local level, Brazil has gathered experience in clean development mechanisms that aim for social equity, whereby local stakeholders participate in decision-making processes (Benites-Lazaro and Mello-Théry, 2019). Since several Brazilian HEI develop cutting-edge socioecological research (Joly et al., 2019), academic engagement is paramount to ensure the best business practices. In this paper, we discuss fronts in business that demand academic engagement with a transdisciplinary perspective. We divided them into two types: (1) existing business issues related to socioenvironmental licensing; and (2) new business opportunities that emerge on the bioeconomy front.

Corporate biodiversity practices in Brazil and globally: contradictionsA growing number of corporations are investing in projects and activities related to biodiversity and ecosystem conservation and restoration, including associations and alliances, to set standards and deliver better results (see global and Brazilian examples in Table 2). In 2017, a global cross-commodity survey showed that out of 718 globally monitored companies, financial success in those committed to reducing deforestation in supply chains was almost three times higher than in companies without commitments (Donofrio et al., 2017). Among these companies, those focused on palm, timber, and pulp products lead the restoration initiatives, whereas the soy and cattle sectors are the main drivers of tropical deforestation. Reasons for concern and scepticism that intentions might not always be translated into actions come with scandals, as in 2015 when the world saw a major multinational motor company cheating carbon emission tests in the United States (http://www.bbc.com/news/business-34324772). Another piece of evidence is the low number of companies that expressed concerns about biodiversity in their mission statements between 1900 and 2014 (Garnett et al., 2016).

Examples of initiatives and opportunities for business and biodiversity globally and in Brazil.

| Initiative | Description | Reference |

|---|---|---|

| United Nations Global Compact | To date, it gathers 11,500 companies committed to “operate responsibly based on sustainability principles accepted universally”. | www.unglobalcompact.org |

| Consumer Goods Forum | There are 400 member companies across 70 countries, including retailers, manufacturers, and service providers. Net zero deforestation commitment by 2020 through the responsible sourcing of key commodities —soy, palm oil, timber, and pulp and beef. | www.theconsumergoodsforum.com |

| European Green Deal | It covers all the economic areas and establishes policies for environmental indicators and safeguarding actions for European Union countries, which must be carbon neutral by 2050, and are already hitting targets in 2023. All commercial partners of the EU must follow the same criteria and practices. | European Commission (2019) |

| Equator Principles | The principles stipulate why and how financial institutions should consider environmental and social issues in their project finance operations. 111 institutions adopt them in 37 countries. | Wright and Rwabizambuga (2006); www.equator-principles.com/index.php/members-and-reporting |

| CEBDS | The Brazilian Business Council for Sustainable Development (CEBDS, a national branch of the worldwide WBCSD) unites 59 Brazilian corporate groups around common sustainability goals. | www.cebds.org |

| Life (Lasting Initiative for Earth) Certification | This certification is the only one that applies solely to best management practices related to biodiversity, irrespective of sector, commodity type, or size of the company. It quantifies the impact of specific corporate practices on natural resources and guides conservation actions to compensate for impacts. The UNCBD and the Brazilian Ministry of Environment recognized it as an essential tool. However, its adoption remains shy compared to other sector- or commodity-specific certifications. | www.institutolife.org; Instituto Life (2014); Reale et al. (2018) |

| ISE | The Brazilian Corporate Sustainability Index (ISE) was created in 2005 and is operated by B3, the Brazilian Stock Exchange. It compares the performance of companies listed at B3 regarding corporate sustainability based on economic efficiency, environmental balance, social justice, and corporate governance. It pays off to invest in the ISE because it does not result in risk investment or disadvantage during challenging market periods. | www.iseb3.com.br; Ortas et al. (2012); Orsato et al. (2015) |

| Brazilian Climate Emergency Bill | Bill proposed to Brazilian National Congress in July 2020 to approve a National Climate Emergency Response Plan to establish targets for the country to become carbon neutral by 2050 and policies for a sustainable transition. | https://static.congressoemfoco.uol.com.br/2020/07/PL-Emerg%C3%AAncia-Clim%C3%A1tica.pdf |

In Brazil, there is a similar paradox: recent major environmental disasters, including human casualties in mining (Pires et al., 2017; Magris et al., 2019) and oil sectors (Magris and Giarrizzo, 2020) contrast with some progressive corporate movements and discourses (Table 2). For instance, dozens of companies and private sector federations gathered to address a statement about their concerns with the Amazonia to the Brazilian President in July 2020 (Brazilian Business Council for Sustainable Development, CEBDS, 2020 — see Table 2). The Brazilian Foundation for Sustainable Development (FBDS) and CEBDS also organized workshops gathering representatives from scientific fields and the business sector to settle commitments and provide input for Brazilian chief negotiators from the Ministry of Foreign Affairs before the 15th Conference of the Parties of the CBD (CEBDS and FBDS, 2021). In addition to the growing pressure of the global and regional political agreements, Brazilian consumer consciousness regarding the supply of natural resources and biodiversity conservation is also rising: 93% of consumers in the country have heard about biodiversity, and an even more significant proportion has heard of sustainable development or fair trade (Moon, 2019).

Our argument in this paper is two-fold: (1) HEIs cannot help businesses comply with legislation – that is up to them and for the public authorities to monitor and sanction non-compliance –but can partner with the private sector to turn compliance into a source of gain for business, biodiversity, and society; (2) HEIs can partner with businesses to tap on new opportunities related both to new biodiversity practices or existing best practices. Table 3 summarizes six innovation fronts, three related to each of the arguments (1) and (2), which are discussed in more detail next.

Innovation fronts on the biodiversity component of businesses and opportunities for academic engagement in Brazil.

| Scope | Innovation front | Business Challenges | Opportunity for academic engagement | References |

|---|---|---|---|---|

| Pressing issues | Environmental licensing | Political instability around existing legislation; governmental bureaucratic hurdles. | To develop information systems that might increase the transparency of environmental impact assessments; to revisit standards that enhance both quality and speed of licensing process. | Abessa et al. (2019); (2019) |

| Biodiversity offsets | To address by intervention rather than company-wide; to account for local communities’ perspectives in the decision-making process; absence of offset culture. | To define safeguards, metrics, and methods for inclusion of stakeholders in the decision-making process; to understand the relationship of biodiversity offsetting with the provision of ecosystem services. | Bull and Strange (2018); Souza et al. (2021) | |

| Private reserves | To decide whether to invest in buying land for protection or in existing protected areas; how to incorporate private reserves in biodiversity, climate, and water offsets of specific interventions. | To provide metrics and information systems that inform government and society about the relevance of such areas for biodiversity conservation; to set conservation and restoration priorities that might inform corporate investment in private reserves. | Kamal et al. (2015); Silva et al. (2021) | |

| New opportunities | Environmental and Social Governance (ESG) | Incorporating, measuring, and reporting impacts (positive and negative) on biodiversity. | To scientifically refine the incorporation of the biodiversity component on ESG metrics. | Miralles-Quirós et al. (2018) |

| Access and Benefit Sharing (ABS) | To deal and understand Brazil’s position in the global ABS scenario and simultaneously deal at the national level with governmental bureaucratic hurdles and expectations of local communities that, as knowledge holders, are to benefit from this type of arrangement. | To provide safeguards and metrics for benefits and develop participatory methods that define agreements between companies and knowledge holders for ABS; to develop information systems that might increase transparency and monitoring of agreements. | Muzaka and Serrano (2019) | |

| Bioeconomy | To deal with governmental bureaucratic hurdles; to cope with infrastructural and capacity limitations in some areas where a bioeconomy is more likely to flourish. | To define metrics and standards to track the transition from a conventional economy to a bioeconomy at the local, subnational, and national levels; to assess impacts of change on human well-being and biodiversity conservation. | Valli et al. (2018); Nobre and Nobre (2020); Bastos-Lima (2021) |

Environmental licensing, biodiversity offsets, and private reserves are very significant pressing issues in terms of the area cover they affect, and they also synergize with one another and with other fronts (listed in Table 3). The lenience and even incentivization of the Brazilian government (2019–2022) to environmental malpractice have made these issues even more pressing (Abessa et al., 2019).

Environmental licensingBrazilian procedures regarding environmental licensing are consistent with international best practices, but there are problems with validation, implementation, enforcement, compliance, and corruption (Andalaft, 2019; Oliveira et al., 2019). The environmental impact assessment (EIA) – one of the most widespread tools for project licensing globally – has several problems in Brazil, including a lack of detailed technical guidance for implementers and an absence of public transparency of both the process and the resulting data (Dias et al., 2019). Moreover, there are also queries regarding the quality of many of the EIAs produced. The socioecological mining tragedies are evidence of the flaws of EIAs and the licensing process as a whole (Pena et al., 2017). We argue that a more substantial presence of academia in biodiversity monitoring and reporting during the EIA process and its involvement in the construction of public information systems can make licensing more cost-effective for corporations (e.g., Andalaft, 2019; Dias et al., 2019; Oliveira et al., 2019). Souza and Sánchez (2018) provide a specific example demonstrating for Brazilian vegetation in a limestone quarry that the quality of the EIA is positively related to the quality of the offset, which we examine next.

Biodiversity offsetsBiodiversity offset is a policy tool to compensate for unavoidable adverse impacts of projects and interventions (BBOP, 2012). Licensing legislation demands compensation or “no net loss” (NNL), which is achieved when impacts on biodiversity are balanced out by actions such as conservation, rehabilitation, and restoration (Rainey et al., 2015). When the gains exceed the losses, the project achieves a “net positive impact” (NPI). Therefore, biodiversity offsetting must bring additionality, i.e., a positive balance between the compensatory action results and the moment before the action (Gonçalves et al., 2015). Commitments towards NPI can be advantageous for companies to avoid conflicts with local communities, to secure supply chains related to natural resources, and even to offer access to financial institutions that adopted the Equator Principles (Table 2), with loans conditioned to NNL of natural habitat and NPI in critical habitat (BBOP, 2018). There are technical issues when discerning between NNL and NPI (Bull and Brownlie, 2017) regarding ecological uncertainties related to criteria or measurements that challenge the definition of the threshold between one and the other (Moreno-Mateos et al., 2015) and the definition of the time needed for offsets to provide expected gains (Curran et al., 2014). The proposed offset quality as compared to the pre-impact conditions is also a concern (Weissgerber et al., 2019). Crowe and ten Kate (2010) and Curran et al. (2014) argue that translating such complexity into offset calculations is often limited to targeting just one or few (e.g., species composition, habitat structure, and cultural values) of the multiple dimensions of biodiversity (structural, functional, evolutionary, cultural, economic). Some such difficulties are possibly behind the fact that less than one-third of the 66 global companies that had committed to biodiversity-specific NNL/NPI in 2001 kept such commitments active by 2016, and less than half specified mitigation hierarchy application or reference scenarios (de Silva et al., 2019).

This picture emphasizes the need for deeper academic engagement to apply science-based metrics to evaluate corporate performance concerning biodiversity, particularly in Brazil. South America, primarily due to Brazil’s contribution, is more dominant in terms of global offsetting area than other continents (Bull and Strange, 2018). Nevertheless, this is not reflected in academic engagement. A survey of 477 papers on biodiversity offsets showed that less than 1% was produced in Brazil (Coralie et al., 2015), and by 2018 Brazil and other Latin American countries, such as Colombia and Mexico, still received less research attention on biodiversity offsets than countries on other continents (Bull and Strange, 2018). This is surprising since Brazil has policies that allow and require offsetting practices, such as EIA, for an environmental license to operate (Villarroya et al., 2014; Gelcich et al., 2017). These patterns suggest that companies committed to offsetting their impacts on biodiversity in Brazil are seldomly interested in going beyond compliance (Souza et al., 2021).

Private reserves and other effective conservation measuresConservation of natural ecosystems can serve business purposes such as offsetting, Access and Benefit Sharing (ABS) and Environmental and Social Governance (ESG). Worldwide, the establishment of private reserves is becoming widespread in diverse forms (Bateman et al., 2015) to the extent that it now even seems to demand a taxonomy at the IUCN based on the private protected land’s tenure and security (Kamal et al., 2015). In Brazil, protected area legislation includes a category of private reserves called RPPNs (Private Natural Heritage Reserves). It consists of stretches of land within private properties voluntarily set aside by the landowners for conservation purposes. Such designation to the ground is permanent and perennial: irrespective of the land sale, the law enforces future owners to protect it. The only incentive landowners receive to register part of their land as RPPNs is an abatement in property taxes. More than 1200 RPPNs cover 8004 km2 (Silva et al., 2021), c. 1.5% of the total covered by public terrestrial protected areas in Brazil (1,530,000 km2; Vieira et al., 2019). Among those, there is discreet participation of large corporations.

Additionally, other private land types are protected and are not accounted for within the national system of protected areas. For instance, Vale and Votorantim are large companies that hold private reserves where research and conservation occur at different levels. Vale’s reserve in Linhares (230 km2), Votorantim’s Legado das Águas (310 km2), and Votorantim’s Legado Verdes do Cerrado in Niquelândia (230 km2) together cover nearly the equivalent of 10% of the area collectively protected by RPPNs in the country. However, these areas are not considered in national protected area calculations because they do not fit the federal legislation stipulations. Since nearly 53% of the remaining native vegetation in the country lies within private properties (Soares-Filho et al., 2014), including a fraction of that private land in the national panorama for biodiversity and ecosystem services conservation is essential for Brazil and could improve public-private dialogue for conservation.

While RPPNs are an option, there are mandatory areas to be protected within farms, according to the Brazilian Native Vegetation Protection Law (NVPL; a.k.a. the “New Forest Code”; Brancalion et al., 2016). Legal Reserves and Permanent Preservation Areas, as they are called, currently do not account for the conservation budget either (but see Silva et al., 2021). NVPL has created a market for trading native vegetation certificates (CRAs) that allows landowners to compensate for restoration obligations by conserving native vegetation elsewhere (Brancalion et al., 2016). When at full implementation, this scheme could become the largest market for trading native vegetation in the world that generates co-benefits by fostering payment for ecosystem services (PES) programs focused on biodiversity conservation, water security, and climate regulation (Soares-Filho et al., 2016; but see Vieira et al., 2018). We postulate that it is the appropriate time to revisit Brazil’s protected area system to promote its expansion and collect and bring private conservation data into its reporting routine to the CBD. This endeavor, again, requires significant involvement of scientists for various tasks: defining priority areas for private conservation or restoration; cataloging and monitoring species and ecosystems within such regions; estimating ecosystem service flows; developing new techniques for valuing ecosystem services to help determine standards for compensation and offset; and devising new incentive mechanisms (see Meiβner, 2013).

According to NVPL (Soares-Filho et al., 2014; Rezende et al., 2018), the large vegetation debts call for two additional policy instruments that are key to conserving natural areas and demanding engagement between HEI and the private sector: economic incentives for conservation and ecological restoration. The most well-known type of incentive is PES, which can be financial or non-financial, according to several sub-national legislation in Brazil (Young and Castro, 2021). PES existed in a rudimentary form for decades until the 1990s, when it expanded as an integrative conservation mechanism (Wunder et al., 2008). Despite the criticism related to the ethical implications of the economic pricing of nature (Peterson et al., 2010), PES programs have now been implemented in most continents and on different scales: recent accounting registered more than 500 PES schemes (Salzman et al., 2018). Grima et al. (2016) analyzed 40 implemented PES cases in Latin America and showed that projects are started by private sellers (95%, companies, associations, and NGOs). In the case of buyers, there were almost the same number of public (38%) and private buyers (45%) and, less frequently, a mix of public and private buyers (17%). The study concludes that most PES schemes can be considered successful. Among other aspects, positive results were related to compensation, where in-kind contributions (e.g., roads, electricity, and training) seem more effective than cash payments (Grima et al., 2016). Successful PES schemes also flourish in Brazil, especially at the sub-national level (see list of experiences in Scarano et al., 2018b).

Ecological restoration is another sizeable, urgent, and primarily untapped opportunity for corporations in Brazil (Brancalion et al., 2019), although some historic initiatives are often developed as compensation (e.g., Rodrigues, 2009; Scarano et al., 2018a). Reale et al. (2018) showed that of the 11 companies with the best sustainability indices (ISE) in the Brazilian Stock Exchange, only one from the forestry sector demonstrated concern for this component. Auspicious global targets for restoration (such as those set by the biodiversity and the climate conventions) are echoed by Brazil’s commitment to the Paris Climate Agreement by restoring 12 million hectares (Scarano, 2017). Recent prioritization efforts for effective restoration to maximize biodiversity, climate gains, and cost-efficiency, both for the planet (Strassburg et al., 2020) and specific Brazilian biomes (Zwiener et al., 2017; Strassburg et al., 2019), provide reliable scientific background for future interventions.

New opportunitiesRecent excitement with bioeconomy, ABS, and ESG are related to new business opportunities associated with Brazil's conservation and sustainable use of biodiversity (see summary in Table 3). However, there are gaps in policy, knowledge, and practice that can be gradually circumvented with academic engagement with businesses.

BioeconomyBioeconomy in Brazil has more often been associated with biofuels, mainly derived from the country’s breakthrough with sugarcane ethanol use and production (Karp et al., 2021) and with biotechnology applied to agribusiness monocultures (Backhouse, 2021). However, biofuel ethanol has historical issues related to land use, labour, and deforestation (Benites-Lazaro et al., 2020). Biotechnology, in the shape of genetically modified organisms, is associated with socioecological inequalities (Backhouse, 2021). Although biofuel ethanol is not entirely ruled out as an option (e.g., Hernandes et al., 2022), Brazil’s contribution to the global bioeconomy comes at a high cost in terms of socioecological issues locally. The shift toward a socioecological fair and just bioeconomy requires a change in the mindset of corporations (Bastos Lima, 2021).

More recently, however, new bioeconomy opportunities have emerged from the potential for sustainable use of agroecological, pharmaceutical, and cosmetic products derived from the sociobiodiversity (Skirycz et al., 2016; Valli et al., 2018) in the Amazon (Shanley et al., 2012; Nobre et al., 2016; Nobre and Nobre, 2020) and elsewhere (Valli and Bolzani, 2019). Several emerging examples follow at least some of those principles in the country. “Symbiosis Investments” (https://symbiosis.com.br/) focuses on sustainable wood products based on 30 native tree species of the Brazilian Atlantic Forest planted in the consortium, and its operations are science-based (e.g., Garuzzo et al., 2021; Santos et al., 2022). In the Amazon, “Belterra Agroforests” (www.belterra.com.br) invests in large-scale agroforests in degraded areas (Abramovay et al., 2021) and is now building a research institute. “Conexsus” (www.conexsus.org), in the Amazon, Cerrado, and Caatinga, makes the links between private socioecological investments with environmental-impact community businesses (Conexsus, 2019; Abramovay et al., 2021; Scarano et al., 2021).

“Re.Green” (www.re.green) is a newly founded company that aims to restore one million hectares of forests, capture carbon, and return the forests to society as protected areas. It partners with research institutes and universities to achieve its goals. The Brazilian Development Bank (BNDES) launched the Living Forest initiative, a public-private partnership that uses ecological restoration to form ecological corridors and to recover river basins throughout the country (https://www.bndes.gov.br/wps/portal/site/home/desenvolvimento-sustentavel/parcerias/floresta-viva). Another exciting example is farmers’ cooperatives partnering with businesses, non-governmental organizations, international aid, and academia in agroforestry and oil palm production in what used to be degraded or unproductive areas in the Amazon (Futemma et al., 2020).

Suppose only a fraction of the public investment in science and technology in the agribusiness-oriented bioeconomy (Bastos Lima, 2022) were to be applied in the sociobiodiversity-based economy. In that case, Brazil could leapfrog to become a global power in sustainable bioeconomy (see Table 2 for Brazil’s climate emergence bill that awaits congressional review). Despite the apparent potential for this in a megadiversity country (Scarano et al., 2021), Bergamo et al. (2022) argue that four principles should guide the typical extraction approach of forest-based products: zero deforestation, no monocultural practices (with or without native species), equitable benefit sharing with local communities, and strengthening local culture and traditions. When applied to the bioeconomy, all these principles require a scientific background. In this same logic, Scarano et al. (2021), based on an extensive literature review, have listed potential gains and constraints of bioeconomy in megadiversity countries such as Brazil. Improvements include more sustainable use of environmental resources (e.g., in the agricultural and forest-based sectors, in the handling of waste streams and the production of value-added products and bioenergy), renewal of industries, modernization of primary production systems, protection of the environment and enhanced biodiversity by having sustainability and circularity as principles. Potential constraints include the risk of competition between food and bioenergy or biomaterial production causing indirect land use change or deforestation, biodiversity loss, eutrophication, invasive species, high water demand, and risks of subsumption of nature to capital. Scientific engagement with entrepreneurs will be a prerequisite to maximize gains and reduce risks.

Access and benefit sharingDirectly related to the sociobiodiversity-based bioeconomy challenge is the issue of ABS. The Nagoya Protocol of the CBD has governed this theme internationally since it was announced in 2010. It has been set to safeguard fair and equitable sharing of benefits from using genetic resources with traditional knowledge holders (Heinrich et al., 2020). Although having played a key diplomatic role in approving the protocol (Mittermeier et al., 2010), Brazil was the 130th party to ratify it, which only took place in 2021. Although ABS is a reasonably new policy and practice in Brazil, there are already some reported cases of success, especially in the cosmetics sector (e.g., Cassol and Sellitto, 2020; Nobre and Nobre, 2018).

However, several challenges remain. Muzaka and Serrano (2019) see it as a challenge for Brazil to play a global role in ABS while having to overcome its governmental bureaucratic hurdles and attending expectations of local knowledge holders. For instance, Brazil’s legislation and policy that addresses ABS defines that governance as participatory and coordinated by the Genetic Heritage Management Council (CGen) at the Ministry of Environment. Since the publication of the so-called “Biodiversity Law” in 2015, participation has been unbalanced, with a predominance of the private sector and federal government actors over local knowledge holders, civil society, and academics (Castro and Santos, 2022). The presence of academics in policy implementation such as this is also strategic. Muzaka and Serrano (2019) trust that academic engagement with businesses can help provide safeguards and metrics for benefits while devising participatory processes that define agreements between companies and knowledge holders for ABS. Moreover, developing information systems that might increase transparency and monitoring of arrangements will also be essential, as already seen in the case of environmental licensing. Finally, Carvalho Ribeiro and Soares Filho (2022) call for investments in research, market niches, infrastructure, and capacity building and propose the creation of a National Benefit Sharing Fund to advance biodiversity knowledge.

Environmental, social, and governanceThe United Nations Global Compact (2004)’s report on financial markets to a changing world launched the ESG concept. However, only over the last decade has it become a hot topic among businesses since companies are pressured to implement such practices by investors, consumers, and the market (Martins, 2022). Thus, there are now available metrics for ESG, some of which apply to stock exchange ratings, as in the case of Brazilian B3 and its “S&P/B3 Brazil ESG Index” (Amato Neto et al., 2022). Several recent studies on the relationships between ESG investment by companies and their financial performance show that while in developed countries there is a direct positive relationship, this is not the case for developing countries, specifically in Brazil (Garcia and Orsato, 2020; Duque-Grisales and Aguilera-Caracuel, 2021), although others indicate otherwise (Miralles-Quirós et al., 2018). Regardless of this controversy, among ESG metrics and ratings, biodiversity is one of the environmental parameters (Doni and Johannsdottir, 2020). A PricewaterhouseCoopers (PwC, 2019) report indicated that among 1141 companies from 31 countries and across seven industry sectors, biodiversity Sustainable Development Goals 14 and 15 were those of the least concern. Although Brazil was not part of the survey (Chile, Colombia, and Mexico were the Latin American countries assessed), this has been interpreted as an indication of low priority for biodiversity assessment among ESG indicators (Schleich, 2021). Indeed, biodiversity scientists could make an essential contribution to ESG metrics is refining biodiversity incorporation. Sustainable bioeconomy practices, ABS, biodiversity offsets practices, and others we reviewed here could all be accounted for in the ESG metrics.

RecommendationTable 4 shows how businesses and HEIs in Brazil could further address biodiversity challenges and opportunities nationally. It is inspired by the heuristic tool often used in science-policy interface studies known as the “policy cycle” (Ojanen et al., 2021) and, therefore, comprises four stages: (1) agenda setting: assessment of the current state of the relationship between businesses and biodiversity (to which we hope this paper contributes); (2) design: actions to be taken based on the assessment; (3) implementation: steps to launch the policy designed; (4) evaluation: tracking and monitoring of the actions implemented. Two products immediately derive from that framework: one assessment report about business-biodiversity relationships in Brazil, and consequently, a policy (or a set of policies) to address existing gaps and issues. Models, examples, and even existing structures can develop the products in both cases. For instance, Brazil has a very active Brazilian Platform on Biodiversity and Ecosystems Services (BPBES) – that periodically produces national and thematic assessment reports by engaging multiple actors (Scarano et al., 2019a, b) – and could lead such an initiative. On the policy front, Brazil has some tools and instruments that could inspire or even absorb needs, such as developing a data and knowledge sharing mechanism for EIA, fostering grants to promote research and development to cover knowledge gaps (such as in offsets or bioeconomy, for instance) or building a fund to incentivize biodiversity research applied to challenges addressed in this paper.

Prototype of an actionable blueprint for closer engagement between HEIs and businesses concerning biodiversity in Brazil. Actions follow the four steps of the policy cycle. Content describes the purpose or level whereby the action takes place. Actors are examples of stakeholders that could be involved. Products are the material results of actions. Targets are examples of desirable policy instruments, references are comparable experiences, and existing tools are elements that already exist in Brazil’s science and technology policy framework that can either inspire or be tapped on by HEI-businesses biodiversity initiatives.

| Actions | Content | Actorsa | Products | Possible targets, references, and existing tools and policies | ||

|---|---|---|---|---|---|---|

| Set the agenda | Assessment of current state of knowledge, funding, cases, transparency | Academic (e.g., BPBES, SBPC, ABC) and industry federations (e.g., CNI), and NGOs (e.g., CEBDS) | BPBES assessment report | Other BPBES assessments, IPBESb assessments and related action platforms produced by industry or academic federations | ||

| Design | Draft policy(ies) to address business-HEI partnerships in issues such as licensing, offsets, private reserves, bioeconomy, ABS, ESG, and others set by the agenda | Governments and/or CNI, sectoral industry federations, individual companies, academic federations, NGOs | Public policy (national or sub-national) and/or business policy, such as those related to knowledge building, capacity building, data sharing and transparency, and funding | Possible targets:1. Data and knowledge sharing tool for EIAs2. Grants for HEI-industry biodiversity partnerships3. National fund to foster knowledge enhancement on biodiversity | Referencesc:1. Runhaar (2016)2. GOALI (NSF, USA)3. Amazon Fund | Existing toolsd:1. SiBBr, Portal Bio2. CNPq-companies partnership3. Map of Innovation Funding |

| Implement | Any level: national, sub-national, local, or business level | The above actors, plus participation of local actors of interest, when applicable | ||||

| Evaluate | Definition of metrics, monitoring, tracking, mapping, and assessing outcomes of policy implementation, which will occasionally set new agendas. For instance, the Atlantic Forest Pact is an example of industry, NGO, government and academic collaboration that has developed monitoring protocols for restoration (Viani et al., 2017). | |||||

Acronyms: BPBES = Brazilian Platform on Biodiversity and Ecosystem Services (www.bpbes.net.br); SBPC = Brazilian Society for the Progress of Science; ABC = Brazilian Academy of Science; CNI = National Industry Confederation.

IPBES = Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (www.ipbes.net).

Runhaar (2016) provides examples on EIA knowledge systems and their interactions with other systems. GOALI = Grant opportunities for academic liaison with industries of the National Science Foundation, USA (www.nsf.gov/eng/eec/goali.jsp). The Amazon Fund is funding mechanism to curb deforestation in the Amazon (www.amazonfund.gov.br).

SiBBr = Brazilian Information System for Biodiversity (www.sibbr.gov.br) of the Ministry of Science and Technology. PortalBio = Biodiversity Platform (www.portaldabiodiversidade.icmbio.gov.br) of the Ministry of Environment. CNPq = Brazilian Research Council, which has a partnership program with companies (https://www.gov.br/cnpq/pt-br/acesso-a-informacao/acoes-e-programas/programas/ciencia-sem-fronteiras/empresas). Map of Innovation Funding is a tool that maps the mechanisms that support innovation in Brazil.

This essay shows much room for more substantial academic engagement between biodiversity scientists and businesses in Brazil. Existing public policies (regarding compensation, offsetting, conservation/restoration within private properties, and ABS) and private sector sustainability policies (including ESG and bioeconomy opportunities) demand scientific backing. While it is encouraging to see several successful initiatives reviewed here, there are still multiple hurdles to building a solid HEI-business relationship that mainstreams biodiversity conservation and best practices into businesses in Brazil. Challenges include policy design and implementation gaps, science and technology, and dialogues through participatory processes. The data emerging from this potential engagement will help refine theory and practice related to fields such as those examined here and provide new insights related to public and private conservation and restoration policies and procedures. Achieving the targets of the CBD’s Post-2020 Global Biodiversity Framework, including reducing ecosystem and biodiversity loss rates, will require understanding the threats and risks businesses impose on biodiversity, how fast they change in type and intensity, and how to avert them (Leadley et al., 2022). This cannot be fully achieved if data from private properties and private businesses are not part of the equation (e.g., Joppa et al., 2016), particularly considering the large territory cover that such areas represent. For instance, when and if implemented, the land to be protected by the Forest Code plus existing RPPNs is more than double the land protected by public protected areas (Soares-Filho et al., 2014). Academic engagement and associated scientific publications, alongside enriched biodiversity datasets and databases, would also increase private sector practices' quality and transparency. Before businesses can innovate to deliver sustainable processes and products from a biodiversity viewpoint, companies and HEIs will need to innovate their mindset to build effective partnerships to face the urgent biodiversity challenges that Brazil and the planet now encounter. Thus, academia should see a great frontier where scientific knowledge and practice can be expanded in challenges related to biodiversity in the private sector. In academia, companies should see a necessary partner to tackle biodiversity challenges with seriousness, commitment, and transparency they demand.

Conflicts of interestNone.

COPPETEC funds the research of ACFA, FRS, RLB, and VFF. The International Institute for Sustainability (IIS, Rio de Janeiro) supports FRS, RL and PDB. VFF is partially supported by a Brazilian Research Council’s (CNPq) productivity grant (#310119/2018-9). CNPq (grant #306694/2018-2), INCT in Ecology, Evolution and Biodiversity Conservation funded by MCTIC/CNPq (grant #465610/2014-5) and FAPEG (grant #201810267000023) fund the research of RL. CNPq (Proc. 304289/2019-1) and FAPERJ (E-26/203.062/20) supports the research of RLB. The University of Miami and the Swift Action Fund support the research of JMCS. FRS also thanks the graduate programs that host his research (Ecology - PPGEcologia and Environmental Science and Conservation - PPG Ciências Ambientais e Conservação – both at UFRJ; and the Professional Masters on Sustainability Science at the Pontifical Catholic University – PUC). We thank Julie Topf for language revision and editing. Finally, we thank Pedro Brancalion, Karen Holl and one anonymous reviewer for important suggestions that raised the profile of the paper.