To restore 12 million hectares of native vegetation in Brazil by 2030, aligning environmental policies with incentive measures is crucial. The Ecological Fiscal Transfer (known as Ecological ICMS in Brazil) allows states to redistribute the ICMS tax (similar to the Value Added Tax) revenue based on environmental criteria, likely motivating municipalities to take environmental action. São Paulo recently modified its ecological ICMS legislation, increasing the ICMS revenue distributed according to environmental criteria and introducing a new criterion for native vegetation cover. We assessed the impact of these changes on tax redistribution, considering three scenarios: the former rules (2021), the new rules (2025), and the new rules with 1.5 million hectares of vegetation restored (2042). While the pattern of ICMS distribution remained mostly unchanged, there were distributional effects. Some municipalities lost up to 5% of their initial revenue, while others with high socio-environmental importance doubled their revenues. Existing environmental criteria still lack incentives for local environmental policies. However, the new criterion for native vegetation cover could, with practical limitations, boost municipal revenue after restoring 1.5 million hectares. São Paulo's initiative to incorporate native vegetation cover into an Ecological Fiscal Transfer policy holds the potential to inspire similar tax-based environmental incentives worldwide. However, it must be adapted to motivate local governments to embrace restoration actions rather than serving primarily as a compensatory measure.

Brazil faces a concerning rise in tropical forest loss, with the highest net loss occurring in the world (Global Forest Watch, 2020). Despite protective legislation and the establishment of protected areas, command and control policies have been insufficient to achieve international climate agreements' goals of curbing deforestation (Barbosa et al., 2021). To address this, Brazil has committed to restoring 12 million hectares of native vegetation by 2030 under the Paris Agreement (MMA, 2017). To meet this target, Brazil must synchronize environmental command and control policies with incentive policies to encourage local governments and landowners to assume voluntary commitments.

One innovative approach is Brazil's implementation of an Ecological Fiscal Transfer policy called Ecological ICMS (ICMS ecológico in Portuguese - Rocha et al., 2020; Ruggiero et al., 2022). The ICMS tax (Imposto sobre Circulação de Mercadorias e Serviços in Portuguese) represents the largest source of state revenue in Brazil (Ring, 2008). It is also an essential source of revenue for local governments. The ICMS is a tax on goods and services, similar to the value-added taxes in other countries (Rocha, 2019). The Ecological ICMS allows the states to redistribute ICMS revenues to municipalities as a policy for environmental conservation and restoration (da Silva Jr. et al., 2019).

São Paulo, Brazil's leading ICMS collector, introduced Ecological ICMS in 1993, initially focusing on state-protected areas without incentivizing additional conservation efforts (Ruggiero et al., 2022; São Paulo, 1993). The other environmental criterion was flooded areas for hydroelectric power generation (dams or reservoirs), another compensatory mechanism for the municipality. However, in 2021, the State expanded the Ecological ICMS to include solid waste management and native vegetation cover outside protected areas, doubling the proportion linked to environmental indicators (law n. 17,348/2021). These changes aim to incentivize municipalities to enhance their environmental performance.

São Paulo's Forest Inventory shows a meager 4.9% (215 mha) increase in native vegetation over ten years, falling short of the restoration target set by the Brazilian Native Vegetation Protection Law (∼769 mha of Permanent Preservation Areas – APP - Tavares et al., 2021). The Refloresta SP Program, announced at COP26, strives to restore 1.5 million hectares through mandatory and voluntary initiatives. The new Ecological ICMS can support municipalities in promoting restoration within their territories, aiding the State's overall objectives.

Ecological Fiscal Transfer schemes are increasing worldwide, and their impact evaluation is beginning (Comini et al., 2019; Cao et al., 2021; Ruggiero et al., 2022). However, the new Ecological ICMS in São Paulo is a unique law in Brazil and the first to include native vegetation cover as an environmental criterion. It has not yet been scientifically evaluated. Therefore, this study aimed to evaluate the effects of the new Ecological ICMS in the State of São Paulo on the municipal ICMS quotas and revenues. The specific objectives were: (1) to describe the distributional impact of the new environmental criteria (who wins and who loses in the new rule); (2) to describe the importance of the new environmental criteria for the municipal ICMS quota and revenue; (3) to estimate the future distributional impact considering a possible native vegetation restoration scenario.

Material and methodsStudy areaThe State of São Paulo (Figure A1) covers 248,209 km2. It contains large agricultural and urban areas but also essential remnants of the Atlantic Forest (54,312 km2) and the Brazilian savannas - Cerrado (2393 km2), both considered biodiversity hotspots (Mittermeier et al., 2011). The native vegetation of those biomes covers 33% and 3% of their original coverage in the State (Nalon et al., 2022). The State comprises the São Paulo macrometropolis, the largest metropolitan region in Brazil, with 22 million inhabitants, and one of the world's ten most populous metropolitan regions. The State is divided into 645 municipalities, and the economic distribution and coverage of native vegetation are very heterogeneous.

Changes in ecological ICMS in the State of São Paulo and the municipal ICMS quota calculationThe study focuses on the difference between the municipal ICMS quota in São Paulo State based on the ICMS redistribution law of 1993 (that modified the original law 3201/1981 with the inclusion of Ecological ICMS) and an estimated quota in the future (2025) considering new environmental criteria established in 2021. The municipal ICMS quota is the percentage that each municipality will receive depending on its performance in each criterion (e.g., added value, population, protected area, native vegetation, etc). We also estimated the municipal revenue (municipal quota multiplied by the amount of money collected each year in the State) as described in section “Scenarios modeling”.

Meetings were held with the Secretary of Environment, Infrastructure, and Logistics (SEMIL-SP) and the Secretary of Finance to develop the model. Initially, the law defined seven criteria for ICMS quota calculation, increasing to nine in 2021 (Table 1). Each criterion has a specific weight for the municipal ICMS quota calculation. The weight of added value (economic criterion) was reduced by 1% and redirected towards environmental criteria: native vegetation cover and solid waste management, described in item “Modeling municipal ICMS quota for 2021 and 2025 scenarios”. The two other environmental criteria (flooded area and protected area) were also modified. The first one only considered hydroelectric power reservoirs. The change in 2021 included reservoirs for public water supply. Protected areas not in the National System of Conservation Units (SNUC in Portuguese acronym) were excluded from the second criterion.

Criteria used to transfer the municipal ICMS quota in the 1993 and 2021 laws in the State of São Paulo.

| Criteria* | 1993 law | 2021 law |

|---|---|---|

| Municipal Added value | 76% | 75% |

| Population | 13% | 13% |

| Municipal tax revenue | 5% | 5% |

| Cultivated area | 3% | 3% |

| Fixed value | 2% | 2% |

| Flooded area (reservoir) | 0,5% - only hydroelectric power reservoir | 0.5% - hydroelectric power and water supply reservoirs |

| Protected area | 0,5% - SNUC and others | 0.5% - only SNUC |

| Native vegetation cover | – | 0.5% |

| Solid waste management | – | 0.5% |

*Explanation of each criterion.

Municipal Added value – the share of the municipal contribution concerning the total São Paulo State's ICMS tax revenues;

Population - total population of the municipality;

Municipal tax revenue – the total amount of municipal tax revenue;

Cultivated area – total area in the municipality of land used for agricultural production;

Fixed value – a fixed value, the same for all municipalities;

Flooded area – reservoirs (flooded area) in the municipality for hydroelectric power;

Protected area – only state-protected areas in the municipality (i.e. municipal or federal protected areas are not considered) defined by the SNUC (second and third columns) and other State protected areas in the case of the second column.

We first calculated two scenarios: one based on the 1993 law (2021) and another considering changes from the 2021 law (2025). The model does not consider transitional provisions between 2022 and 2024. Another disclaimer is that our model considered the ICMS amount collected in 2019 (R$ 30,010,595,558 ∼ US$ 6,002,119,111) to avoid the economic influences of the pandemic in 2020 and 2021. The ICMS amount in the municipalities can vary significantly yearly, affecting the added value and, consequently, the municipal ICMS quotas.

DatasetData from the Secretary of Finance and Secretary of Environment, Infrastructure and Logistics were used for the 2021 and 2025 scenarios (Table A1). Each criterion was estimated following the state government calculus presented in the law.

Flooded area (reservoir): Flooded area index was calculated based on the municipality's area of reservoirs using data from the Coordination of Electric and Renewable Energies (CEER) for hydroelectric power reservoirs and the Water Resources Coordination (CRHi) for reservoirs for public water supply. The flooded area (ha) in each municipality is divided by the total flooded area in the State to obtain the flooded area index.

Protected area: Data from the São Paulo State Forest Foundation in 2021 (Figure A2) were used to calculate the protected area index for each municipality, considering weights assigned to different protected areas (Table A2 – Detailed methods in Appendix B).

Native vegetation cover: The native vegetation cover index for each municipality is calculated based on the area with native vegetation cover. There are two conditions under which municipalities can score on this index: 1) if the municipality has ≥ 30% of native vegetation outside strictly protected area (ecological station, biological reserve, state park, natural monument, and wildlife refuge); or 2) if the municipality does not have achieved the first criterium but has native vegetation in Environmental Protection Areas (APA – a type of protected area similar to category V from IUCN) or areas of protection and recovery of water sources. In the first case, the municipal score for native vegetation cover equals the hectares of native vegetation outside the strictly protected areas. In the second case, the score equals the hectares of native vegetation in these two specific protected areas. We used data from the forest inventory of the State of São Paulo (Nalon et al., 2022) for native vegetation, from the Forest Foundation for protected area protection, and for recovery of water sources, we used data from the Coordination of Environmental Planning. The score of each municipality was divided by the sum of the scores of all municipalities to obtain the native vegetation cover index.

Solid waste management: The solid waste management index is based on performance indexes for selective waste collection, consortia or inter-municipal arrangements, and waste landfill quality (Appendix B). Data from the Coordination of Environmental Planning (SEMIL-SP) were used for calculations.

Scenarios modelingCriteria for calculating the municipal ICMS quota were standardized to a 0–100 scale, where the sum of all municipalities' values equals 100. The final municipal ICMS quota was calculated based on the sum of criteria index values multiplied by respective weights (Equations 1 and 2).

Equation 1

Equation 2

Where:ICMSq = municipal ICMS quota

add = municipal added value

pop = population

tax = municipal tax revenue

agr = cultivated area

fix = fixed value

res = flooded area (reservoir)

pa = protected area

veg = native vegetation cover

sw = solid waste management.

We multiplied the municipal ICMS quota by the ICMS amount collected in 2019 (US$ 6,002,119,111) to obtain the total amount received by each municipality in each scenario (received revenue). We also multiplied the ICMS from 2019 by the criteria index to evaluate the importance of the environmental criteria for the municipal revenue from the ICMS redistribution, i.e., the amount of ICMS revenue coming from environmental criteria compared to other criteria. Finally, we divided the total amount received by the municipalities by the population to evaluate the impact on the per capita value.

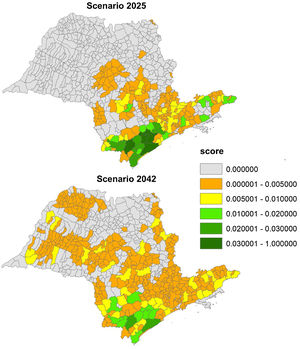

The scenario of native vegetation restoration (2042)A future scenario of native vegetation restoration for 2042 was developed based on the Refloresta SP Program target (1.5 Mha). Mandatory riparian APP buffers, total riparian APP buffers, and restoration of low agricultural suitability pastures were considered until each municipality achieved a minimum native vegetation percentage (Appendix B - Mello et al., 2021; Tavares et al., 2021). Thus, Scenario 2042 considers the current native vegetation cover (scenario 2025) with the addition of 1.5 Mha of restoration. We then calculated the native vegetation cover score for each municipality and the increase in the municipal ICMS quota compared to scenario 2025.

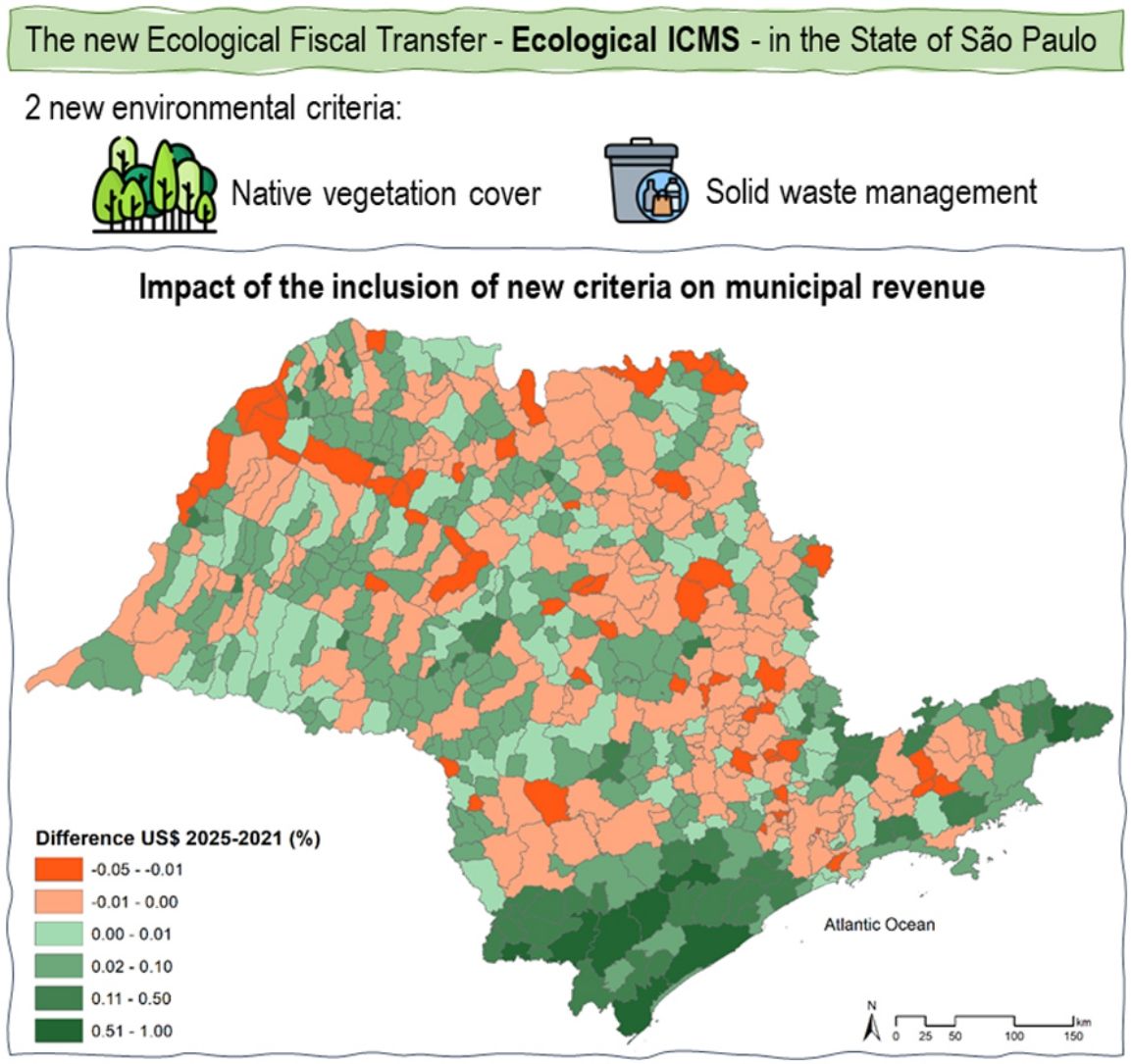

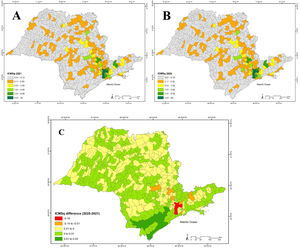

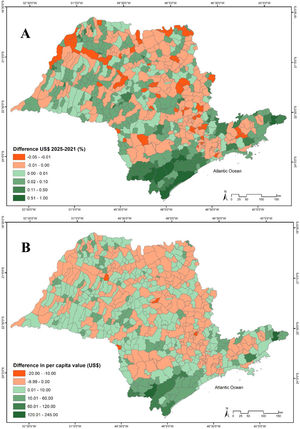

ResultsMunicipal ICMS quota and revenue redistribution (scenarios 2021 and 2025)Among the 645 municipalities in the State of São Paulo, the municipal ICMS quota decreased for 268 municipalities and increased for 377 municipalities in the 2025 scenario compared to 2021 (Fig. 1C). The city of São Paulo had the largest nominal decrease, but the overall distribution of the quota across municipalities remained largely unchanged (Figs. 1A and 1B). However, notable variations were observed at the municipal level, with some municipalities experiencing a significant increase of nearly 100% in their revenue (Fig. 2A). These revenue increases were predominantly observed in municipalities located in the Ribeira de Iguape River basin on the southern coast and the Paraíba do Sul River basin (Figure A3) on the northern coast. These municipalities have extensive coverage of native vegetation due to their mountainous terrain but low population density and limited agricultural and industrial activities, resulting in lower added value compared to more populated or agriculturally intensive municipalities like São Paulo and Campinas (Figure A3).

The municipalities with high increases in ICMS quota almost doubled their revenue. For instance, Iguape and Eldorado (Figure A3) presented an increase of approximately US$1.6 million, representing a revenue increase of 57% and 77%, respectively (Table A3). Despite not scoring high on socioeconomic criteria such as added value and population (Figure A4), these municipalities experienced a substantial boost in their revenue due to the ICMS changes. On the other hand, municipalities with decreased ICMS quotas experienced a revenue loss of no more than 5% compared to 2021 (Fig. 2A and Table A4). This pattern occurred because high ICMS quotas are associated with high scores in socioeconomic criteria. Environmental criteria contribute only 2% to the municipal ICMS quota, while added value, population, own tax revenue, and agricultural production account for 75%, 13%, 5%, and 3%, respectively. São Paulo city had the highest decrease in municipal ICMS revenue, amounting to an estimated loss of 9.87 million US$ in 2025, which represents only 0.84% of the amount received in 2021, with environmental criteria contributing only 0.13% to the municipal ICMS quota (Table A5).

Only four municipalities witnessed losses ranging from US$10 to US$20 per capita between the two scenarios (Fig. 2B). On the other hand, the municipalities with the most significant increase in the municipal ICMS quota presented a per capita value increase of up to US$ 245.

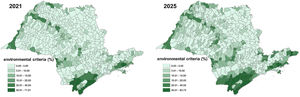

Importance of the environmental criteria for the municipal ICMS quota and revenueIn scenario 2021, environmental criteria contributed to at least 20% of municipal revenue in 31 municipalities, with only five municipalities relying on these criteria for 50% or more of their revenue (Fig. 3, Table A3). However, in 2025, 63 municipalities derived at least 20% of their revenue from environmental criteria, and 11 municipalities depended on these criteria for 50% or more of their revenue (Fig. 3). The inclusion of new environmental criteria increased their importance in municipal revenue, with their contribution to the municipal ICMS quota rising from 1% to 2%.

Municipalities situated in the coastal zone scored high on criteria related to protected areas and native vegetation cover (Figure A5). This region is home to state-protected areas such as ecological stations and state parks, as well as remnants of the Atlantic Forest (Figures A1 and A2). The central part of the State achieved moderate scores due to the presence of environmental protection areas, which allow sustainable use and impose fewer restrictions on agricultural activities, resulting in lower scores for the protected area criterion. Nonetheless, these areas contributed to the overall score of municipalities in this region because the native vegetation within these areas also scores.

Eldorado presented the most significant revenue coming from the native vegetation cover criterion (1.6 million US$), accounting for 45% of its municipal ICMS quota in 2025. Other municipalities, such as São José do Barreiro and Tapiraí (Figure A3) obtained around 50% of their municipal ICMS quota solely from environmental criteria in the 2025 scenario.

The reservoir criterion received high scores for municipalities encompassing major reservoirs in the Tietê, Paranapanema, Rio Grande, and Paraná rivers, including the city of São Paulo and its surrounding areas (Figure A3), due to hydroelectric power generation and water supply (Figure A5). The solid waste management criterion displayed a more evenly distributed pattern across the State, with highly populated municipalities scoring high (Figure A5).

Scenarios of native restoration (2042)In the 2025 scenario, out of the 209 municipalities that achieved a score on the native vegetation cover criterion, the introduction of mandatory restoration of 1.5 million hectares (Mha) of native vegetation through Permanent Preservation Areas (APP) and voluntary commitments in the 2042 scenario resulted in an expansion to 402 municipalities (Fig. 4). Municipalities that did not score on this criterion in the 2025 scenario experienced revenue increases of up to US$ 348,000, as seen in the case of Itapeva (Table A6, Figure A3). Nine municipalities witnessed an increase of over US$ 200,000 in revenue through this criterion.

DiscussionThe distribution pattern of ICMS among municipalities in the State of São Paulo did not substantially change after the inclusion of new environmental criteria. Municipalities with large transfers continued to receive large amounts after the 1% shift from economic to environmental criteria. However, high environmental and social interest municipalities, such as those in the Ribeira de Iguape river basin, experienced a significant distributional effect. Their revenue from ICMS redistribution sometimes doubled due to the new environmental criteria, particularly the criterion for native vegetation cover. Municipalities in this area house traditional rural populations and show low social indexes (IBGE, 2022), coexisting with high ecological importance (Gomes et al., 2020).

São Paulo still has a low percentage of ICMS redistribution based on environmental criteria compared to other states in Brazil. Some states allocate 5% or more of the state revenue redistribution to environmental criteria (da Silva Jr. et al., 2019). São Paulo's protected areas criterion is similar to other states, but it lacks additional criteria like indigenous lands and sewage collection and treatment. However, São Paulo introduced a unique criterion: native vegetation coverage outside protected areas.

While the overall redistribution pattern remained unchanged, the inclusion of new environmental criteria had a significant impact on municipalities with low population density and economic incomes, primarily in forested areas like the Ribeira de Iguape and Paraíba do Sul River basins. Certain municipalities experienced revenue increases of up to 100%, while the maximum revenue decrease was 5% for disadvantaged municipalities. This pattern was also observed for the changes in revenue per capita, where most municipalities will lose around US$ 15, and others will increase it by US$ 245. By 2025, the number of municipalities with at least 20% of their revenue from environmental criteria could reach 63 out of 645 municipalities in São Paulo.

The two environmental criteria previously used in the Ecological ICMS regulation in São Paulo have a compensatory nature: flooded area and protected area. Municipalities with reservoirs receive compensation for not using the land, while revenue from protected areas is based on the proportion of municipal area covered by them (Loureiro, 2002; May et al., 2002). The predominance of compensatory criteria does not incentivize the creation of new protected areas or local environmental policies (Droste et al., 2017; Comini et al., 2019; Ruggiero et al., 2022). Furthermore, the score for the protected area criterion only considers state-protected areas, excluding municipal-protected areas, which is different from other states (da Silva Jr. et al., 2019; Ruggiero et al., 2022). Qualitative measurements and assessments of the environmental quality of protected areas are lacking in São Paulo, to maintain a progressive improvement in the preservation of these areas (Oliveira et al., 2018). Municipalities could incentivize landowners to create Private Natural Heritage Reserves (RPPN in the Portuguese acronym) recognized by the State to increase the score for protected areas. This could encourage the expansion of protected areas, with the municipality acting as an ally for mobilizing rural landowners. The problem is that the score for this type of protected area is very low (0.1, Table B1).

The criterion for solid waste management is population-dependent, resulting in uniform scoring. Implementing simple solid waste management actions could provide a stimulus for municipalities without any score in this criterion.

The new criterion for native vegetation cover outside protected areas was an innovation in São Paulo. However, the requirement of 30% or more native vegetation coverage restricts this criterion to specific regions, such as the coastal zone (Figure A1). Many municipalities find it challenging to reach this threshold, limiting the criterion's effectiveness as an incentive for forest restoration. The presence of APAs contributes to medium vegetation cover scores in the central part of the State. This criterion thus can work as an incentive for creating environmental protection areas and the forest restoration inside them. Even though the Ecological ICMS does not consider municipal APAs, the municipality can make arrangements with the State for the creation of a state APA. Still, a more direct stimulus for restoration outside these protected areas is lacking.

The Refloresta SP aimed at restoring native vegetation in São Paulo, could significantly increase the number of municipalities scoring in the native vegetation cover criterion. The restoration foreseen by Refloresta SP could lead to higher revenue from ICMS redistribution. The total costs for forest restoration could even be lower than the average value of Ecological ICMS received by the municipality (Rocha et al., 2020). Therefore, the Ecological ICMS allocation to stimulate the native vegetation restoration practices enables compliance with environmental legislation and increases the green economy based on forest-product markets from the restoration (Lemos et al., 2021; Urruth et al., 2022). However, the implementation of the Refloresta SP program is uncertain due to the change in government after the October 2022 elections (Ruggiero et al., 2021).

Our case study in the São Paulo state demonstrates that it is possible to increase the participation of environmental criteria in ICMS redistribution to municipalities without significant negative economic impacts. It is crucial to communicate with local governments about the benefits of improving scores and to inform them that adopting incentive programs for rural landowners can contribute to increased revenue from the native vegetation cover criterion. The research results can be used to estimate ICMS revenue changes and applied to other states and nationally to assess the importance of Ecological ICMS in Brazil. It can also contribute to guiding Ecological Fiscal Transfer policies worldwide (Box 1).

Ecological ICMS in the Brazilian Federal Constitution.

| A national legal change in the Federal Constitution took place in 2020 through Constitutional Amendment 108/2020. This amendment introduced a 10% redistribution of the ICMS based on educational criteria. As a result, the percentage of ICMS based on the tax collected by the municipality was reduced from 75% to 65%, while 25% was maintained according to criteria established by the states. |

| For our analysis, we utilized data from 2021. However, it should be noted that as of the writing of this article, the State of São Paulo had not yet implemented the newly approved rule of 10% ICMS redistribution based on educational criteria. Consequently, our focus was on the disparity between the current municipal ICMS quota in the State of São Paulo, as established by the 1993 law, and the projected quota in the future (2025), considering the new environmental criteria stipulated by the 2021 law. |

| Upon the implementation of the 10% ICMS redistribution based on educational criteria in the State of São Paulo, there will be a substantial change in the amounts allocated to municipal ICMS quotas. However, the effects of the environmental redistribution criteria, as calculated in this study, will remain proportionally consistent. Our model can be instrumental in evaluating this recent change in the Federal Constitution. |

| This recent amendment to the Federal Constitution represents a significant advancement for the education sector in Brazil and has opened the door for discussions on incorporating environmental criteria into the general rule for all States, thereby further reducing redistribution based on economic criteria. Based on our findings and the redistribution rules of other states, we recommend engaging in a dialogue with the National Congress to allocate a minimum of 5% of the total ICMS amount for distribution among municipalities based on environmental criteria related to restoration and/or conservation. Implementing a comprehensive environmental regulation at the national level will serve as a crucial instrument to reinforce intergovernmental tax transfers as incentivizing policies for conservation. |

Our analysis of São Paulo's Ecological ICMS policy reveals its potential and limitations in driving environmental conservation through fiscal mechanisms. While the broader distribution of ICMS revenues remains relatively steady, the policy's inclusion of new environmental criteria brings a positive distributional effect for municipalities with high environmental and social relevance in regions with extensive native vegetation cover. As São Paulo embarks on an ambitious native vegetation restoration program (Refloresta SP), the Ecological ICMS policy could be a powerful lever, motivating municipalities to contribute to ecological restoration. However, most environmental criteria are compensatory and do not incentivize the adoption of local environmental policies and actions. Furthermore, the native vegetation cover criterion can be challenging for municipalities with low coverage. We suggest that the State consider additional environmental criteria, such as indigenous lands and sewage collection and treatment, as implemented by other states. Overall, the Ecological ICMS criteria changes may foster environmental concerns within economic policies with just a 1% change in the distribution rule. An eventual increase in this percentage could further foster environmental policies at the municipal level. São Paulo's initiative to incorporate a native vegetation cover criterion into an Ecological Fiscal Transfer policy holds the potential to be adopted in similar situations worldwide. However, it must be adapted to motivate local governments to embrace restoration actions rather than serving primarily as a compensatory measure.

FundingThis work was supported by the São Paulo Research Foundation, FAPESP [grant numbers 2016/1780-2; 2017/24028-2; 2018/25147-8; 2021/10125-1 and 2022/03860-0].

Declaration of interestsThe authors declare the following financial interests/personal relationships which may be considered as potential competing interests:

Kaline de Mello reports financial support was provided by State of Sao Paulo Research Foundation.

We thank Fernanda Andrade Silva Nader from the Secretary of Environment, Infrastructure and Logistics of the State of São Paulo (SEMIL-SP), Sheyne Cristina Leal from the Secretary of Finance of the State of São Paulo (SEFAZ-SP), José Ronal Moura de Santa Inez from the State Basic Sanitation Engineering Company (CETESB), and Arlete Tieko Ohata (SI-SP) for providing data and contributions to our understanding of law implementation and enforcement.